The Energy Consulting Group

Management consultants for upstream oil and gas producers and service companies

| Western Canadian Oil and Gas, Exploration and Production Industry |

|

E&P News and Information Scandinavian International and National International Energy

Agency Department of Trade and Norwegian

Petroleum Ministry of Industry

and E&P Project Information |

|---|

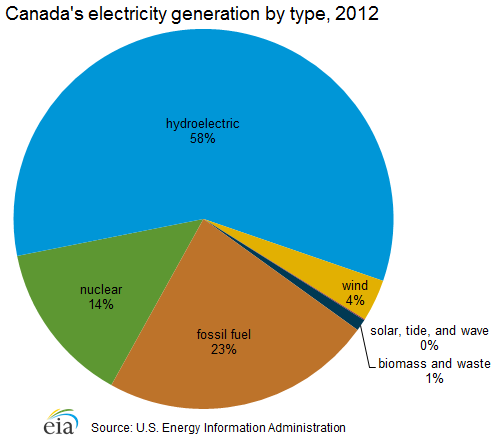

Canadian Oil Production and Reserves |

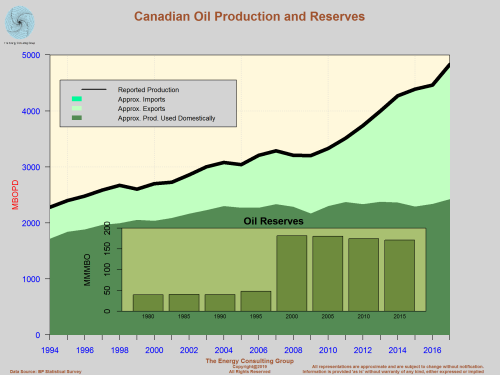

Canadian Gas Production and Reserves |

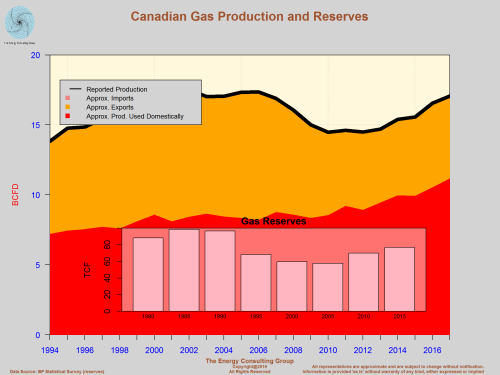

Canadian Oil-Gas Industry Overview |

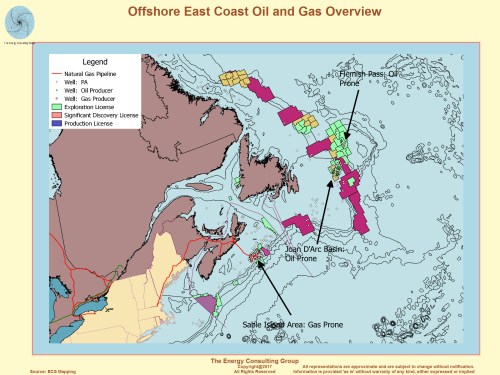

Canadian Offshore East Coast Oil and Gas Overview |

Canada: Main Onshore Oil and Gas Plays |

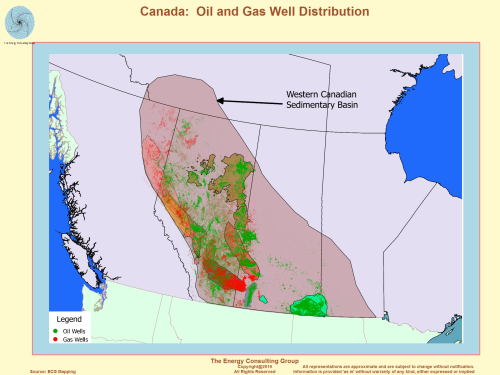

Canada: Onshore Oil and Gas Well Distribution |

|

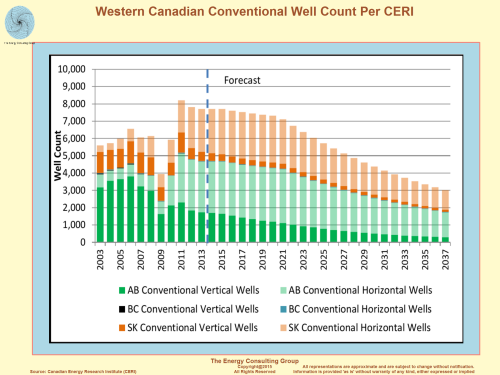

Western Canadian Conventional Well Count Per CERI (link to original CERI report)  For Higher Resolution, Click Image |

|

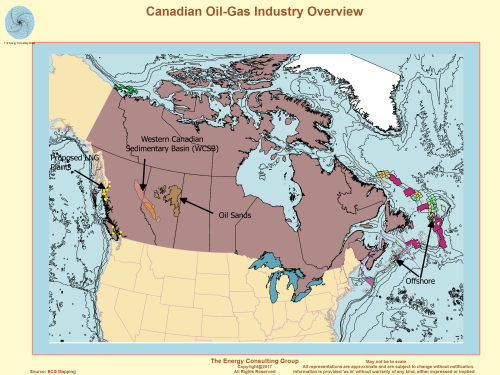

Canada: EIA Country Overview

(source: EIA)

EIA Overview

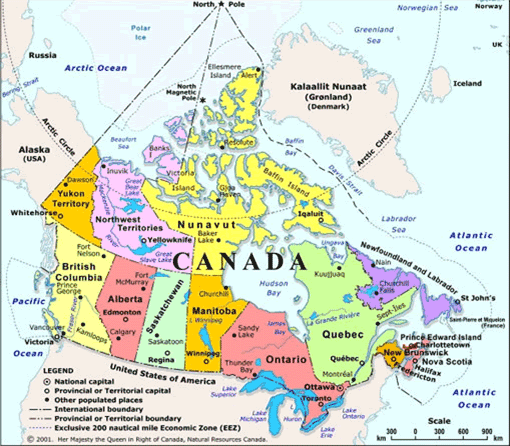

Canada is one of the world's five largest energy producers and is the principal source of U.S. energy imports.

Canada is a net exporter of most energy commodities and is an especially significant producer of conventional and unconventional oil, natural gas, and hydroelectricity. It stands out as the largest foreign supplier of energy to the United States, its southern neighbor and one of the world's largest consumers of energy. Just as the United States depends on Canada for much of its energy needs, so is Canada profoundly dependent on the United States as an export market. However, economic and political considerations are leading Canada to consider ways to diversify its trading partners, especially by expanding ties with emerging markets in Asia.

Canada is endowed with an exceptionally rich and varied set of natural resources, ranking among the five largest energy producers in the world, behind China, the United States, Russia, and Saudi Arabia. Canada produced an estimated 19 quadrillion British thermal units (Btu) of primary energy in 2012, relative to 13.3 quadrillion Btu of primary energy consumed. Canada was the world's seventh largest energy consumer after China, the United States, Russia, India, Japan, and Germany. Canada has a population of more than 35 million (37th largest in the world) with a gross domestic product (GDP) on a purchasing power parity basis of $1,526 billion (13th largest in the world) in 2013.1

Canada's economy is relatively energy intensive compared to other industrialized countries, and is largely fueled by petroleum, natural gas, and hydroelectricity.

Oil

Canada's oil sands are a significant contributor to the recent growth and expected future growth in the world's liquid fuel supply, and they comprise most of the country's proved oil reserves, which rank third globally.

Overview

Canada is the world's fifth-largest oil producer, and virtually all of its crude oil exports are directed to U.S. refineries. Canada is a major onshore and offshore producer of crude oil, and the recent growth in its liquid fuels production has been driven by bitumen and upgraded synthetic crude oil produced from the oil sands of Alberta. Most of Canada's reserves and the expected future growth in Canada's liquid fuels production will be derived from these resources.

Reserves

According to the Oil & Gas Journal (OGJ), Canada had 173 billion barrels of proved oil reserves at the beginning of 2014. The Alberta Energy Regulator places Canada's reserves at 169 billion barrels of proved oil reserves at the end of 2013.2 Canada controls the third-largest amount of proved reserves in the world, after Venezuela and Saudi Arabia. Among the top ten reserve holders, the only other state that is not a member of the Organization of the Petroleum Exporting Countries (OPEC) is Russia. Canada's proved oil reserve levels from 1980 to 2002 were well below 10 billion barrels. In 2003, they rose to 180 billion barrels after oil sands resources were deemed to be technically and economically recoverable. The oil sands now account for approximately 167 billion barrels,3 nearly all of Canada's current proved oil reserves.

Sector organization

Canada has a privatized oil sector that includes the active participation of many domestic and international oil companies. Many Canadian oil firms recently underwent strategic corporate restructuring, including a wave of consolidation in the wake of the recent economic downturn. The unique and technically sophisticated production processes required in the exploration and production of Canada's oil sands resources promote regional and functional specialization by independents and the subsidiaries of major companies.

Many Canadian firms have a presence in the upstream oil and gas industry, from large-scale active or planned commercial projects to smaller pilot projects that serve as test beds for new technologies. The largest Canadian energy companies with a presence in the domestic upstream and downstream activities include Suncor (which acquired Petro-Canada in 2009), Syncrude, Canadian Natural Resources Limited, Imperial Oil, Cenovus (which was spun off from Encana), and Husky Energy. Other Canadian companies, particularly Enbridge and TransCanada, dominate midstream pipeline infrastructure.

The participation of international oil companies (IOCs), both private and state-owned, in Canada's oil sector has risen rapidly. Aside from economic and political motivations, investments in the oil sands enable foreign companies to gain technological expertise that can be applied to unconventional resources elsewhere. The Investment Canada Act stipulates that any large investment in Canada must be of net benefit to Canada, indicating possible limits on foreign control of strategic commodities, but these limits have been invoked infrequently. U.S. private sector firms involved in Canada's upstream and/or downstream oil industry include Chevron, ConocoPhillips, Devon Energy, and ExxonMobil. BP, Shell, Statoil, and Total are among the other major IOCs4 with producing or planned projects in the oil sands.

Chinese companies, including PetroChina and its China National Petroleum Corporation (CNPC) parent company, the China National Offshore Oil Corporation (CNOOC), and Sinopec, have invested heavily in the oil sands and other parts of Canada's energy sector. PetroChina owned a 60% stake of the MacKay River and Dover projects from Athabasca Oil Corporation, followed by full acquisition of MacKay River in January 2012. In 2010, Sinopec acquired ConocoPhillips' stake in Syncrude Canada. One notable foreign acquisition is CNOOC's $15 billion acquisition of Nexen. With the acquisition, CNOOC became the first Chinese company to operate a commercial-scale oil sands operation.5

Federal and provincial bodies coordinate policy and regulation in Canada. Provincial authorities, the largest and most influential of which is the Alberta Energy Resources Conservation Board (ERCB), handle most sector oversight. The national regulatory body is the National Energy Board (NEB).

Exploration and production

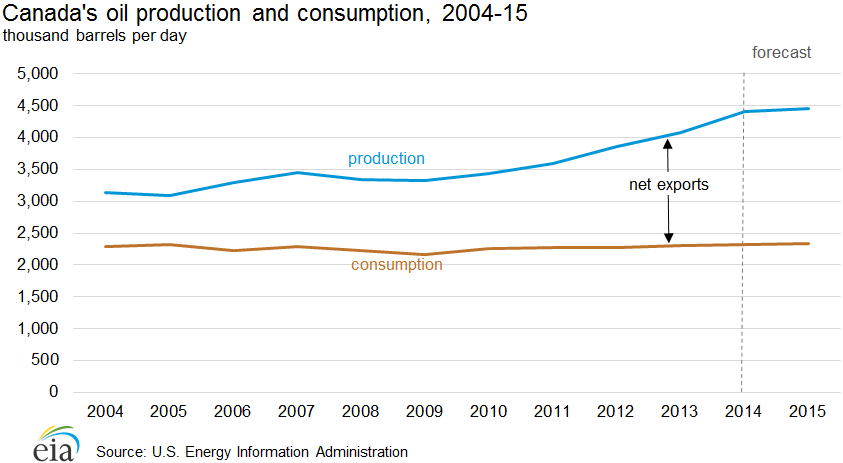

Canada produced more than 4 million barrels per day (bbl/d) of petroleum and other liquid fuels in 2013, an increase of more than 930,000 bbl/d from a decade ago. Of this production, 3.3 million bbl/d was crude oil and a small amount of lease condensate.

Oil production in Canada comes from three principal sources: the oil sands, the resources in the broader Western Canada Sedimentary Basin (WCSB), and the offshore oil fields in the Atlantic Ocean.6 Production from the oil sands accounted for more than half of Canadian oil output in 2013, a proportion that has steadily increased in the past decade. In total, Alberta was responsible for 78% of Canadian oil production in 2013. About 80% of Alberta's production came from the oil sands.7 Other noteworthy producing provinces are Saskatchewan, with 13% of national output from its share of the WCSB, and offshore areas on the east coast of Canada, primarily in Newfoundland and Labrador.8 Production from offshore reserves off the coast of the eastern provinces comes from mature oilfields, with few opportunities to mitigate decline rates. Accordingly, western provinces are expected to comprise an increasing proportion of overall Canadian oil production in the future.9

Canada is expected to be one of the largest sources of growth in global liquid fuel supply, in both the near term and long term. EIA's Short-Term Energy Outlook forecasts that Canada's production will grow by an annual average of 180,000 bbl/d in 2014 and 2015. Looking forward, the 2014 International Energy Outlook projects that Canadian production could grow to 6.7 million bbl/d by 2040 as a result of the growing expansion of the oil sands.

Oil sandsCanada's most important oil-producing region is the oil sands in Alberta, especially the Athabasca deposit. The oil sands are permeated with bitumen, which is a form of petroleum in a semi-solid state that is typically found blended with sand, clay, and water in its natural state.

Two predominant methods of extraction are used in the oil sands: traditional pit mining on the surface and in-situ drilling underground. When mined at the surface, bitumen-rich earth is shoveled into trucks for separation at a processing facility. Surface mining has historically been the largest source of production from the oil sands, but its share has declined in the past few years because approximately 80% of bitumen reserves are situated too deep underground to be accessible by surface mining. The other method, in-situ extraction, injects steam into underground formations to soften the bitumen and pumps it to the surface through wells. Steam-assisted gravity drainage (SAGD) and cyclic steam stimulation (CSS) are the two leading in-situ extraction techniques.10

As the experience and technology in producing hydrocarbons from oil sands matures, the cost of extraction falls. While previously more expensive than U.S. tight oil production, oil from oil sands in Alberta is now more competitive with U.S. tight oil production costs. In-situ projects in Alberta are estimated to break even at an average of $64 and mining projects between $60-$65 per barrel, whereas tight oil from the Permian Basin has an estimated cost of $81 per barrel, Bakken $69 per barrel, and Eagle Ford about $64 per barrel.11

Once extracted, bitumen is a heavy, viscous type of crude oil. In order to flow in a pipeline, the bitumen must be diluted with condensate or other light oils or "upgraded" by complex processing units ("upgraders") into a light, sweet "synthetic" crude oil (SCO). Of the crude oil and equivalent production in 2013 reported by Statistics Canada, 28% was SCO and nearly 30% was crude bitumen.12

The largest oil sands projects are surface mining operations, although there are a greater number of in-situ projects. There are more than a dozen notable current and planned oil sands operations include:13

- Syncrude Canada is a joint venture by leading oil sands operators in mining and upgrading operations in the projects of Mildred Lake and Aurora. Syncrude received regulatory approval for a roughly 200,000 bbl/d expansion in Aurora Southtrain. Phase 1 is expected to start up in two years.

- Suncor Energy's production averaged 361,000 bbl/d of upgraded SCO and non-upgraded bitumen in 2013,14 less than the nameplate capacity from its core Millennium mining site and the Firebag and MacKay River in-situ projects combined. Suncor has announced a number of planned greenfield and brownfield expansions in Chard, Lewis, Meadow Creek, Voyageur South, and additional stages to its Firebag and MacKay River operations. Suncor also began construction as a joint venture with Total develop the Fort Hills mine (160,000 bbl/d).

- Shell Albian Sands is the leading owner and operator of the Athabasca Oil Sands Project, which includes the Muskeg River mine (155,000 bbl/d), Jackpine mine (100,000 bbl/d), and the Scotford upgrader. Shell has received regulatory approval for expansions to its Muskeg and Jackpine operations. The company also has suspended plans for its Pierre River project.

- Canadian Natural Resources has two significant producing projects as well as a number of large planned projects. Horizon Oil Sands is an integrated mining and upgrading facility that can produce up to 135,000 bbl/d of light, sweet SCO in its first phase. Horizon will undergo process improvements and expansions over the next few years. Its other large project, Primrose/Wolf Lake, has an in-situ capacity of 120,000 bbl/d. The company also began its first phase of operations at the in-situ Kirby project, with planned expansions for 2017 and 2022. Later this decade and into the next decade, Canadian Natural Resources aspires to construct other medium-sized in-situ projects, including Birch Mountain, Gregoire Lake, and Grouse.

- Imperial Oil operates one of the largest in-situ projects, Cold Lake, which has a current capacity of 140,000 bbl/d and could grow further with a 40,000 bbl/d CSS expansion, currently under construction. The company is also operating its Kearl project, a 110,000 bbl/d mining operation with an expansion of 110,000 bbl/d scheduled to start in 2015. Imperial has regulatory approval for an initial 45,000 bbl/d in-situ Aspen project.

- Cenovus operates two large in-situ projects, Foster Creek and Christina Lake, through a joint venture with ConocoPhillips. Foster Creek was the first commercial SAGD project and now produces approximately 120,000 bbl/d, with additional phases in various stages of development. Christina Lake operates at a capacity of 138,800 bbl/d with expansion up to 150,000 bbl/d. Cenovus has also announced additional in-situ projects at East McMurray, Grand Rapids, Narrows Lake, Steepbank, Telephone Lake, and West Kirby.

- Devon Canada operates the in-situ Jackfish project, which includes two fully operational phases and one under construction, each with a capacity of 35,000 bbl/d. The Pike project, currently in the application stage of regulatory approval, will also have three phases, each of 35,000 bbl/d capacity.

- CNOOC, after its acquisition of Nexen, operates the Long Lake project. It includes a SAGD facility that is producing 72,000 bbl/d of bitumen, from which 59,000 bbl/d of SCO will be produced from an upgrader that became operational in 2009. The next phase of Long Lake, Kinosis, has a planned capacity of 80,000 bbl/d.

- ConocoPhillips produces almost 30,000 bbl/d from the first phase of the Surmont in-situ project, with an expansion to 109,000 bbl/d planned for 2015. It also acts in a 50-50 partnership with Cenovus on Christina Lake and Foster Creek.

- Husky Energy operates the 30,000 bbl/d Tucker in-situ project north of Cold Lake. It plans to eventually bring online a much larger Athabascan in-situ project, known as Sunrise. Sunrise will be developed in three phases over the 2014-20 timeframe, with an initial capacity of 60,000 bbl/d and eventual capacity of 210,000 bbl/d.

- MEG Energy operates 60,000 bbl/d of combined production from the first two phases of the Christina Lake in-situ project. A third phase is in regulatory review, which would add 150,000 bbl/d for a total project capacity of more than 200,000 bbl/d.

- Brion Energy, subsidiary of PetroChina, purchased the MacKay River and 40% of Dover in-situ projects from Athabasca Oil Sands Corp. Neither project is currently producing at a commercial scale, but the first phase of MacKay River is scheduled to come online in 2015, at 35,000 bbl/d, with an eventual expansion to 150,000 bbl/d.

- Statoil's presence in the oil sands is focused on the Kai Kos Dehseh in-situ project. Currently operating at 10,000 bbl/d capacity, several phases and expansions are planned.

- Sunshine Oil Sands has announced three separate in-situ projects that it intends to bring online over the next decade at Legend Lake, Thickwood, and West Ells, with a combined future capacity of 290,000 bbl/d. However, over the next few years, initial phases of each project have capacities of 20,000 bbl/d or less.

- Total received regulatory approval for the 100,000 bbl/d Joslyn North mine, but the project has stalled because of costs.

The traditional center of Canada's oil production has been the

Western Canada Sedimentary Basin (WCSB), which stretches from British

Columbia across Alberta and Saskatchewan to Manitoba and part of the

Northwest Territories. This basin contains some of the most abundant

supplies of oil and natural gas in the world. The WCSB remains a

significant source of traditional oil production, despite the fact that

it was surpassed by output from the oil sands in 2006. According to an

analysis of data from the National Energy Board, Canada's production of

crude oil and equivalent in 2013 was approximately 20% conventional

light crude production from WCSB provinces, with an additional 13% being

conventional heavy crude from Alberta and Saskatchewan.15

The depletion rates of traditional oil production in the WCSB are

expected to fall in the coming years, as enhanced recovery techniques

are applied to old wells and new resource deposits. In particular,

technological advances like horizontal drilling and hydraulic fracturing

have made tight oil production from shale formations an increasingly

attractive alternative to traditional production.

The two most prolific tight oil plays in Canada are the Bakken–which stretches across southern Saskatchewan and Manitoba as well as the northeast corner of Montana and North Dakota–and the Cardium formation in Alberta.16 The Bakken has been largely responsible for the recent growth in U.S. crude oil production.

OffshoreMost offshore oil production in Canada occurs in the Jeanne d'Arc Basin, off the eastern shore of Newfoundland and Labrador. Light crude oil production from offshore areas in eastern Canada amounted to 229,000 bbl/d in 2013,17 which was nearly 17% of Canada's total crude oil production.18 Most of Canada's offshore output derives from the Hibernia field, which came online in 1997 and is operated by ExxonMobil, accounting for 135,000 bbl/d of production in 2013.

Two other significant fields in the region are Terra Nova and White Rose. Terra Nova is operated by Suncor on behalf of a large consortium and accounted for 38,000 bbl/d of production in 2013, a substantial decline from the levels achieved in the past decade. Husky Energy operates White Rose, which also produced well below its peak levels, at 56,000 bbl/d in 2013.19 In May 2010, Husky started production at the North Amethyst field, which is one of the satellites to White Rose that could offset declines elsewhere and extend the field complex's production life.20 The large Hebron field is estimated to hold about 700 million barrels of recoverable heavy oil resources, and itis expected to begin production by 2017.21

Canada's offshore exploration and production is confined by numerous regulatory and legal impediments. A 1972 moratorium restricts field development off the Pacific coast, where there are an estimated 9.8 billion barrels of recoverable resources.22 A federal review of offshore drilling prevents progress in the Arctic, but oil companies such as Imperial Oil, ExxonMobil, BP, and Chevron have invested to secure acreage in the Beaufort Sea.23

Trade

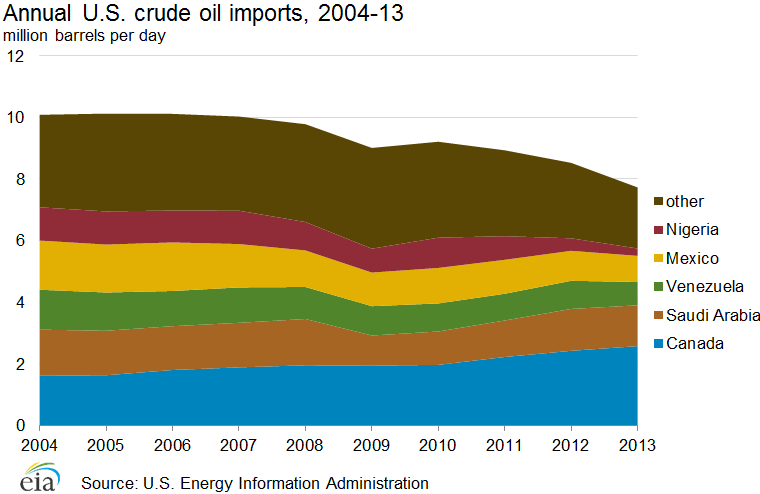

Almost 97% of Canadian oil exports were directed to the United States in 2013,24 and Canada is the largest supplier of foreign oil to the United States. Canada accounted for one-third of U.S. crude oil imports in 2013. That year, the United States imported 3.1 million bbl/d of oil and petroleum products from Canada, of which 2.6 million bbl/d were crude oil, including diluents.

While overall U.S. imports of crude oil are declining, Canada is one of the few countries from where U.S. crude oil imports are increasing. From a decade ago, U.S. imports of Canadian crude have increased 59%, while imports from the other major suppliers have decreased.

Although the United States is a large net crude oil importer from Canada, at 2.6 million bbl/d in 2013, the cross-border oil trade flows in both directions. With existing legal restrictions, Canada is the only country to import U.S. crude oil (133,000 bbl/d in 2013). The United States exported 415,000 bbl/d of petroleum products to Canada in 2013.

Nearly all of Canadian crude oil exports to the United States come from the western provinces25 of which 70% (1.8 million bbl/d) goes to the U.S. Midwest (Petroleum Administration for Defense District [PADD] 2). The U.S. Gulf Coast (PADD 3) imported 128,000 bbl/d from Canada in 2013. While the Gulf Coast refineries are best suited to handle the heavier crudes coming from western Canada, the current pipeline infrastructure allows the Gulf Coast to import less than a tenth of the crude oil that is sent to the Midwest. The eastern provinces, which are more densely populated but have less oil production, import some of the energy products they consume from the United States, including crude oil.

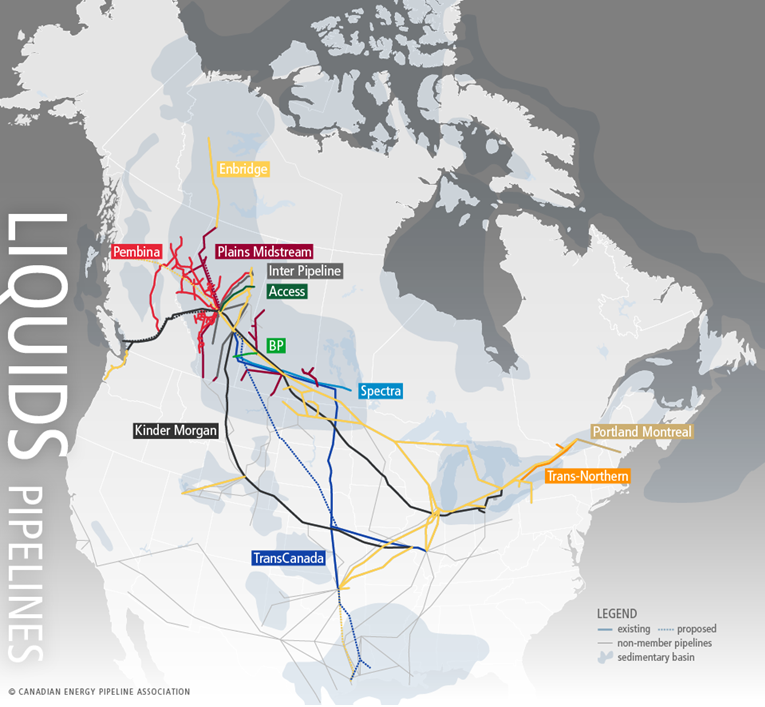

Pipelines

Pipelines connect the centers of Canadian production with refining and export centers in the eastern provinces, western Canada, and especially the United States. Pembina, Plains Midstream, Spectra Energy, Access Pipeline, and Inter Pipeline operate some of the largest domestic pipeline systems in western Canada. Three companies operate the majority of the export pipelines: Enbridge, Kinder Morgan, and TransCanada. In total, members of the Canadian Energy Pipeline Association transport 3.3 million bbl/d of oil over 22,000 miles of pipeline.26 However, an increasing amount of oil is transported by rail to overcome infrastructure constraints in the midcontinent region.

Operational export pipelinesEnbridge operates the largest Canadian export oil pipeline network. The Enbridge Mainline system, composed of the Canadian Mainline and the U.S. Mainline (Lakehead) pipeline networks, transports 2.5 million bbl/d of petroleum and other liquids from western Canada, Montana, and North Dakota to western Canada, the U.S. Midwest, and eastern Canada. The Lakehead system includes the Alberta Clipper pipelines connecting Hardisty, Alberta to Superior, Wisconsin at a capacity of 450,000 bbl/d. An expansion project scheduled to be completed by 2015 will increase the capacity to 800,000 bbl/d.27 The Southern Lights pipeline laid parallel to the Alberta Clipper, but it runs in the opposite direction to transport lighter hydrocarbons back to Alberta for use as a diluent in transporting and processing bitumen.28 Along with its other smaller pipelines on both sides of the border, Enbridge's large pipeline systems transport 68% of the oil exported from western Canada.

Kinder Morgan operates the Trans Mountain Pipeline System, which is the only pipeline system that transports crude oil to the west coast of North America. The pipeline originates in Edmonton, Alberta and travels to various marketing and refining stations near Vancouver, British Columbia. Its capacity is rated at 300,000 bbl/d. Kinder Morgan also operates the cross-border Express pipeline (280,000 bbl/d), which connects with the smaller Platte pipeline in Casper, Wyoming and then travels to Illinois.29

TransCanada has established a foothold in Canada's crude export market through its Keystone system. The 2,600-mile pipeline with a capacity of 590,000 bbl/d runs from Hardisty, Alberta to Manitoba and crosses the border to Steele City, Nebraska where it splits into two systems servicing the U.S. Midwest and U.S. Gulf Coast.30

Proposed export pipelinesTransCanada has proposed an addition to the Keystone system, Keystone XL. The pipeline would travel directly from Hardisty, Alberta to Steele City, Nebraska, with a capacity of 830,000 bbl/d.31 Becuase it would cross an international border, a presidential permit must be granted stating that the project is in the national interest. In May 2012, TransCanada reapplied for a presidential permit after the administration denied its initial application because of environmental concerns that had not been resolved as of the deadline for a decision. TransCanada's new application includes alternative routes through Nebraska. The proposal awaits the administration's decision. In the interim, some of the oil from Alberta has been shipped by rail.32

While Keystone XL was initially proposed as an integrated pipeline from Canada to the U.S. Gulf Coast, a shorter section that is entirely inside the United States was pursued as a separate project when the presidential permit for the cross-border segment was not approved. The TransCanada pipeline that would connect Cushing, Oklahoma with the Texas refining sector is now known as the Gulf Coast Pipeline Project, and would resolve some of the infrastructure constraints that have resulted in a glut of oil at the Cushing hub. Construction on the Gulf Coast Pipeline Project commenced in August 2012 following final approval of its permits by the U.S. Army Corps of Engineers. In January 2014, the pipeline went online operating at 520,000 bbl/d with the potential capacity of 830,000 bbl/d.33

Enbridge, Kinder Morgan, and Spectra have new or expansion pipeline projects in development that would ultimately increase the pipeline capacity to deliver oil from Alberta to the U.S. Midwest and U.S. Gulf Coast, servicing areas in-between.

Enbridge and Kinder Morgan have proposed new or expanded pipelines to the U.S. West Coast, which are only in the preliminary stages of planning and regulatory review. Kinder Morgan aims to expand its existing Trans Mountain pipeline system by building a second pipeline within the same right-of-way. The expansion would increase Trans Mountain's capacity to 890,000 bbl/d. The company has submitted an application with the National Energy Board (NEB) and expects to begin construction in late 2015. Meanwhile, Enbridge is pursuing the Northern Gateway Pipeline Project, which would end at a deepwater port in Kitimat, British Columbia. Northern Gateway would include a 525,000 bbl/d crude oil pipeline and a smaller parallel pipeline to carry condensate back to Alberta expected to begin in 2018.34

The completion of either or both of the competing Kinder Morgan and Enbridge projects would create a new export outlet for oil sands. Additional pipeline capacity to Canada's west coast would reduce Canada's overland dependence on the U.S. market while providing access to growing Asian economies in the Pacific Basin, which could have important implications for trade flows and the prices received by Canadian oil producers. The proposed west coast projects must overcome opposition, particularly due to concerns about the risk of pipeline or tanker spills in British Columbia and among affected aboriginal First Nations groups.35

Rail

The rapidly increasingly supply of liquid fuels from the oil sands in western Canada has far outpaced pipeline capacity and the expansion efforts of the pipeline companies. With infrastructure already in place serving the demand destinations for western Canadian crude, rail has proven to be an adequate substitute. In 2013, crude oil transported by rail reached 200,000 bbl/d36, of which 128,000 bbl/d were exported37 to the United States. Compared to the previous year, exports by rail increased 177%. In 2013, 45% of crude exports by rail went to the U.S. Gulf Coast (PADD 3), 44% went to the East Coast (PADD 1), and 9% went to the West Coast (PADD 5).38

The Canadian Association of Petroleum Producers (CAPP) projects that by 2016, Canada will transport up to 700,000 bbl/d of crude oil by rail. Current rail loading capacity is estimated at 300,000 bbl/d and is expected to increase to 1 million bbl/d by 2015.39

Downstream

According to the CAPP, Canada has 16 refineries with a total crude processing capacity of 1.9 million bbl/d. Western Canada's eight refineries have a total capacity of 679,000 bbl/d, while Eastern Canada's six refineries have 1.2 million bbl/d of capacity.40

Canada consumed an estimated 2.3 million bbl/d of petroleum products in 2013, a gradual but continued increase compared to five years ago. According to CAPP, motor gasoline accounts for 35% of the refined petroleum products produced in Canada, with diesel fuel oil accounting for roughly 26%.41

Natural gas

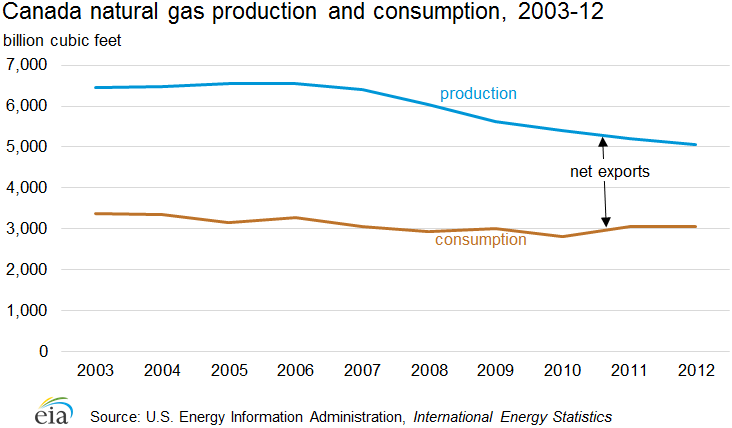

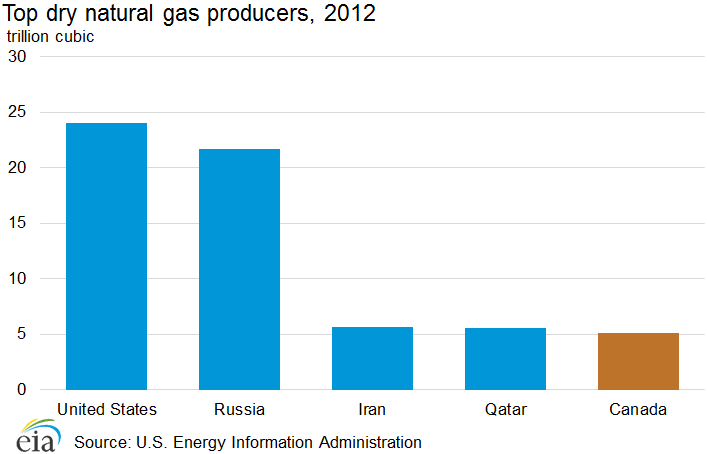

Canada is the world's fifth-largest producer of dry natural gas and the source of most U.S. natural gas imports.

Overview

Despite holding a relatively smaller share of the world's proved natural gas reserves, Canada ranks fifth in dry natural gas production. It is the fourth-largest exporter of natural gas, behind Russia, Qatar, and Norway. Although Canada has plans to export liquefied natural gas (LNG), all of Canada's current natural gas exports are sent to U.S. markets via pipeline.

Reserves

The U.S. Energy Information Administration (EIA) estimates that Canada's proved natural gas reserves were 67 trillion cubic feet (Tcf) at end of year 2012. Most of Canada's natural gas reserves are traditional resources in the WSCB, including those associated with the region's oil fields. Other areas with significant concentrations of natural gas reserves include offshore fields near the eastern shore of Canada, principally around Newfoundland and Nova Scotia, the Arctic region, and the Pacific coast.

Shale gasVast deposits of unconventional natural gas reside in the WCSB in the form of coal bed methane (CBM), shale gas, and tight gas, although they have not been developed as extensively as similar formations in the United States. Canada has an estimated 573 Tcf of technically recoverable shale gas resources, according to an updated assessment prepared by EIA. Five large sedimentary basins in western Canada with thick, organic-rich shales–the Horn River, Cordova Embayment, and Liard in northern British Columbia, the Deep Basins in Alberta and British Columbia, and the Colorado Group in central and southern Alberta–account for 536 Tcf of the total of technically recoverable shale gas resources. The Liard Basin claims the largest share of the total resource. The remaining assessed resources are in three potential shale gas plays of Saskatchewan/Manitoba, Quebec, and Nova Scotia, in which exploration has been limited.

Exploration and production

Canada is the fifth-largest producer of dry natural gas, behind the United States, Russia, Iran, and Qatar. Dry natural gas production has decreased by more than 300 billion cubic feet (Bcf) since 2010. EIA estimates that Canada produced 6.3 Tcf of gross natural gas in 2012, of which 5.1 Tcf was dry natural gas, 5.6 was marketed natural gas, 675 Bcf was reinjected, and 65 Bcf was vented or flared. Most of Canada's natural gas production derives from production in the WCSB. Alberta produced more than two-thirds of Canada's gross natural gas in 2013, according to NEB data,42 with most of the remaining amount coming from British Columbia.

Although production of natural gas is undergoing declines as a result of reserve depletion, technological advances have spurred rapid investment in the region, and natural gas production from the WCSB will increasingly come from shale gas, tight gas, and CBM. A number of major and independent companies, including Encana, Apache, Devon, and Quicksilver, are already active in British Columbia's Horn River shale play43. Foreign interest in the resource was also demonstrated by the joint development agreements that Encana signed with CNPC and Korean Gas Corp. (KoGas) in 201044. Shale gas production in Canada is currently limited, and the shale gas basins in eastern Canada are in even earlier stages of exploration and development.

Offshore natural gas production has been focused primarily off the coast of Eastern Canada, in the Scotian Shelf geological area near the province of Nova Scotia. The most mature project is the Sable Offshore Energy Project (SOEP), of which ExxonMobil has a majority stake45. As it matures, production in SOEP declined. In 2012, SOEP produced 200 million cubic feet per day (MMcf/d) of raw natural gas from a peak of 500 MMcf/d.46 Encana is developing another major natural gas project off Nova Scotia, the Deep Panuke Project, which began production in 2013. The project is designed to produce 300 MMcf/d and up to 892 Bcf during the life of the project47.

Trade

All of Canada's natural gas exports are directed to the United States

via pipeline. However, for the first time, small amounts of LNG were

trucked into the United States. For five months in 2013, Canada sent LNG

via trucks to New England utilities to meet inventory requirements in

anticipation of winter demand. The purchase agreement has been renewed

for 2014.48

The United States imported 2.8 Tcf of

natural gas from Canada in 2013, of which less than 1% (555 MMcf) was

LNG, down from near-peak levels of 3.8 Tcf in 2007. Canada accounts for

97% of U.S. natural gas imports, most of which come from western

provinces. Although the United States is a net importer of natural gas

from Canada, it exported more than 900 Bcf of natural gas to Canada in

2013, a dramatic increase from less than 100 Bcf in 2000. As prospects

for domestic U.S. natural gas production continue to improve, the United

States is expected to have lower natural gas import needs in the future

while exporting more to its North American trading partners.

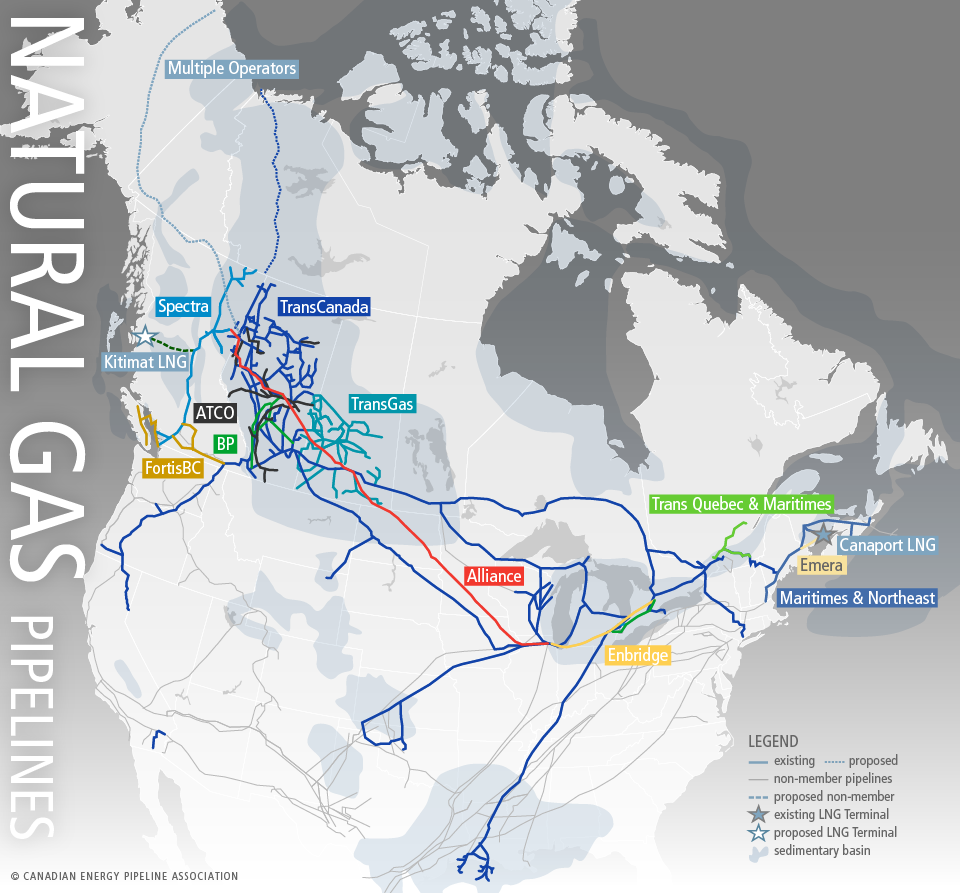

Canada's natural gas pipeline system is highly interconnected with the U.S. pipeline system. TransCanada operates the largest network of natural gas pipelines in North America, including 13 major pipeline systems and 42,50049 miles of gas pipelines in operation. Within Canada, TransCanada operates a 25,100-mile network at a total average volume of 14 Bcf/d50 that includes the NGTL System, the Canadian Mainline, the Foothills, and the Trans Quebec and Maritimes that connect supply in western Canada to the United States. Spectra Energy operates a 1,800-mile, 2.9 Bcf/d pipeline system connecting western Canadian gas supply regions with markets in the United States and Canada.51 Spectra Energy also operates the Maritimes and Northeast Pipeline linking eastern Canadian supplies with consumers in the eastern United States. Enbridge and Veresen operate the Alliance Pipeline, a 2,311-mile pipeline system, delivering 1.6 Bcf/d from the WCSB to Chicago, Illinois which is a significant source of natural gas and NGLs for the U.S. Midwest.52

Liquefied natural gas (LNG)Import terminals

Changes to North American natural gas supply fundamentals have diminished Canada's appetite for imported liquefied natural gas (LNG). As such, plans for seven LNG terminal plans have either been cancelled or suspended. One exception is Canaport, Canada's first and only operational regasification terminal, which began importing LNG in June 2009. The Canaport terminal is operated by Repsol, in partnership with Irving Oil, and has a nameplate processing capacity of 1.2 Bcf/d53. According to the BP Statistical Review of World Energy 2014, Trinidad and Tobago and Qatar, the primary sources of imported Canadian LNG, supplied a combined 35 Bcf in 2013.54

Export terminals

Further proof of the changing outlook

for North American natural gas is provided by the number of applications

for LNG export licenses in the United States and Canada. In Canada,

there have been 20 companies that have applied, and 11 have been

approved by the NEB. Most of the export terminals approved for

development are on Canada's west coast in the province of British

Colombia.55

Kitimat LNG, a facility that was originally proposed as an import terminal, is now in the front-end engineering design phase of development as an export terminal. Kitimat would initially process 1.3 Bcf/d of LNG. The LNG terminal in Kitimat would be fed by shale gas produced in British Columbia. The partners have announced a target start date of 2015 for the first of two potential trains, but this could be optimistic given the upstream and downstream developments that need to occur before operations can begin.

LNG Canada is another project approved for exports. Shell, in cooperation with Mitsubishi, KoGas, and PetroChina, is pursuing a two-train, 1.6 Bcf/d export terminal near Kitimat that would come online in 2020. Pacific Northwest LNG, a venture proposed by Petronas with Japan Petroleum Exploration, is a two-train 801 MMcf/d export terminal in Prince Rupert, British Columbia that would tentatively come online in 2018 and would be supplied by production in the upstream acreage it acquired from Progress Energy. Triton LNG and Woodfibre LNG are expected to commence in 2017 at a capacity of at least 267 Bcf/d each. Aurora LNG, the latest project to be approved is owned by a consortium of China's CNOOC and Japan's Inpex and JGC Corporation and has an expected capacity of 3.2 Tcf/d.56

Coal

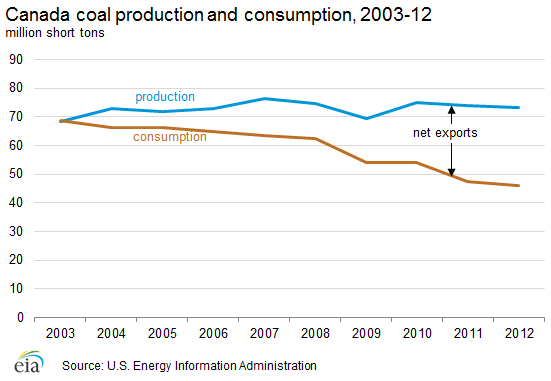

As government policy leads to lower coal consumption down, up to 50% of Canada's increasing coal production is being exported.

Reserves

Natural Resources Canada (NRCan) places the country's resource potential at 9.6 billion short tons of coal resources, and of which 7.3 billion short tons are proved reserves.57 The Coal Association of Canada estimates that historically, more than 50% of the proved reserves are bituminous coal and the remaining amounts are subbituminous and lignite coal.58 Canada's coal resources are found all across its territory, but is actively mined and produced in Alberta, British Colombia, and Saskatchewan.

Production and consumption

In 2012, Canada produced 73 million short tons of coal and consumed 46 million short tons, a significant change in the Canadian coal market from a decade ago. In 2003, Canada consumed all that it produced (69 billion short tons). Since 2003, Canada's production continued to grow, while its consumption has fallen substantially driven by government policy and the increased development of alternatives.

Coal is consumed domestically primarily for power generation. In the provinces of Alberta, Saskatchewan, and Nova Scotia, coal represents more than 50% of electricity generation. The remaining consumption occurs within industry, particularly for the steel and cement industries.59

Trade

In 2012, Canada exported 39 million short tons of coal, representing more than 50% of the coal it produced. A decade ago, Canada exported about 46% of its production. Coal designated for export comes primarily from British Colombia's Elk Valley coal mines, and some from Alberta. NRCan estimates that 90% of exports go by sea from ports in Vancouver and Prince Rupert in British Colombia.60 According to the International Energy Agency (IEA), Canada exported about 83% to Asia, primarily Japan, China, and South Korea in 2013. About 9% was exported regionally to the Americas, including the United States.

Because of its proximity to cheap coal produced in the United States, Canada imports coal to its Central and Eastern provinces. In 2013, the United States exported 7.1 million short tons to Canada.

Electricity

Canada is a net exporter of electricity to the United States, and most of its power needs are met by hydroelectricity.

Generation

Canada generated an estimated 644 billion kilowatthours (kWh) of electricity in 2012, of which 58% was hydroelectric. Only China and Brazil produce more hydroelectricity than Canada. Fossil fuel plants satisfy most of Canada's electricity needs not met by hydroelectricity. According to IEA statistics, approximately two-thirds of Canada's conventional fossil-fueled generation is fueled by coal, with most of the remaining amount generated using natural gas and a small amount of oil.

Capacity

Canada had an estimated 139 gigawatts (GW) of installed electricity generation capacity in 2011. Hydroelectric dams accounted for approximately 75 GW of the total, including one of the largest hydroelectric complexes in the world, the Robert-Bourassa Hydroelectric Generating Station on Quebec's La Grande River.61 Canada is also a large and growing producer of wind energy, mostly because of supportive policies at the federal and provincial levels. According to the Canadian Wind Energy Association, Canada's wind capacity was 8.5 GW as of July 2014. Canada added 1.6 GW of new capacity in 2013.62

Trade

The electricity networks of Canada and the United States are highly integrated, and the United States is a net importer of electricity from Canada. In 2012, Canada exported 58.0 billion kWh of electricity to the United States, while importing 11.4 billion kWh. The major electricity trade flows from Canada to the United States occur from Manitoba to the Midwest and from eastern Canada into the New England, New York, and Midwest Regional Transmission Organizations. On the other hand, the U.S. Pacific Northwest is a net electricity exporter to Canada because its sizeable hydro capacity generates large amounts of electricity in excess of the region's need, particularly when river flows are high in the spring and early summer.63

Notes

- Data presented in the text are the most recent available as of September 30, 2014.

- Data are EIA estimates unless otherwise noted.

Endnotes

2Alberta Energy Regulator, ST98-2014 Alberta's Energy Reserves 2013 and Supply/Demand Outlook 2014-2023, http://www.aer.ca/documents/sts/ST98/ST98-2014.pdf, accessed September 2014.

3Ibid

4Each IOCs website details their operations in Canada

5Gault, Sebastian, "Alberta Oil in China: Concerns over Canadian investment regulations linger," Alberta Oil Magazine (January 9, 2014), http://www.albertaoilmagazine.com/2014/01/seekingthedragon-going-up/; Cattaneo, Claudia and Lewis, Jeff, "Life after CNOOC's Nexen deal: Is China's honeymoon with Canada's oil patch over?," Financial Post (December 7, 2013), http://business.financialpost.com/2013/12/07/life-after-cnoocs-nexen-deal-is-chinas-honeymoon-with-canadas-oil-patch-over/?__lsa=dc62-d035; U.S. Energy Information Administration, "Liquid Fuels and Natural Gas in the Americas," accessed September 2014, http://www.eia.gov/countries/americas/pdf/americas.pdf; Rocha, Euan, "CNOOC closes $15.1 billion acquisition of Canada's Nexen," Reuters (February 25, 2013), http://www.reuters.com/article/2013/02/25/us-nexen-cnooc-idUSBRE91O1A420130225.

6Canada Association of Petroleum Producers, "Crude Oil: Forecast, Markets, and Transportation" (June 2014), accessed September 2014, http://www.capp.ca/getdoc.aspx?DocId=247759&DT=NTV.

7Alberta Energy Regulator, ST98-2014 Alberta's Energy Reserves 2013 and Supply/Demand Outlook 2014-2023, http://www.aer.ca/documents/sts/ST98/ST98-2014.pdf, accessed September 2014.

8Canada Association of Petroleum Producers, "Statistical Handbook for Canada's Upstream Petroleum Industry" (September 2014), table 3.7e, accessed September 2014, http://www.capp.ca/GetDoc.aspx?DocId=241200&DT=NTV.

9Canada Association of Petroleum Producers, "Crude Oil: Forecast, Markets, and Transportation" (June 2014), accessed September 2014, http://www.capp.ca/getdoc.aspx?DocId=247759&DT=NTV.

10Government of Alberta, "Alberta Oil Sands Industry, Quarterly Update" (Summer 2014), accessed August 2014, http://www.albertacanada.com/files/albertacanada/AOSID_QuarterlyUpdate_Summer2014.pdf.

11Mohr, Patricia, "Scotiabank: Commodity Price Index" (February 20, 2014), accessed August 2014, pg 3-4, http://prosperitysaskatchewan.files.wordpress.com/2014/02/scotiabank-oil-costs-feb-20-2014.pdf.

12Statistics Canada, CANSIM, table 134-0001, accessed August 2014, http://www5.statcan.gc.ca/cansim/a33?RT=TABLE&themeID=2026&spMode=tables&lang=eng.

13Oil Sands Review, Canadian Oilsands Navigator, accessed August 2014, http://navigator.oilsandsreview.com/listing; Government of Alberta, "Alberta Oil Sands Industry, Quarterly Update" (Summer 2014), accessed August 2014, http://www.albertacanada.com/files/albertacanada/AOSID_QuarterlyUpdate_Summer2014.pdf.

14Suncor, Monthly Oilsands Production, accessed August 2014, http://www.suncor.com/en/investor/3897.aspx.

15National Energy Board, Estimated Production of Canadian Crude Oil and Equivalent" (August 19, 2014), accessed August 2014, http://www.neb-one.gc.ca/clf-nsi/rnrgynfmtn/sttstc/crdlndptrlmprdct/stmtdprdctn-eng.html.

16National Energy Board, "Canada's Energy Production 2013 – Energy Supply and Demand Projections to 2035 – An Energy Market Assessment," Canada's Tight Oil Production, accessed September 2014, http://www.neb-one.gc.ca/clf-nsi/rnrgynfmtn/nrgyrprt/nrgyftr/2013/nrgftr2013-eng.html#fg2_2.

17Canada Association of Petroleum Producers, "Statistical Handbook for Canada's Upstream Petroleum Industry" (September 2014), accessed September 2014, http://www.capp.ca/GetDoc.aspx?DocId=241200&DT=NTV.

18Canada Association of Petroleum Producers, "Crude Oil: Forecast, Markets, and Transportation" (June 2014), accessed September 2014, http://www.capp.ca/getdoc.aspx?DocId=247759&DT=NTV.

19Canada Association of Petroleum Producers, "Statistical Handbook for Canada's Upstream Petroleum Industry" (September 2014), table 3.8a, accessed September 2014, http://www.capp.ca/GetDoc.aspx?DocId=241200&DT=NTV.

20Husky Energy, Projects, accessed August 2014, http://www.huskyenergy.com/operations/growthpillars/atlantic/projects.asp.

21Hebron, Past and Projected Milestones, accessed September 2014, http://www.hebronproject.com/the-project/past--projected-milestones.aspx.

22Natural Resources Canada, Offshore British Columbia, accessed September 2014, http://www.nrcan.gc.ca/energy/offshore-oil-gas/5843; Wood, Joel, "Lifting the Moratorium: The costs and benefits of offshore drilling in British Columbia" (October 2012), accessed September 2014, http://www.fraserinstitute.org/uploadedfiles/fraser-ca/Content/research-news/research/publications/lifting-the-moratorium-offshore-oil-drilling-in-BC.pdf.

23Canadian Broadcasting Corporation News, "Oil companies seek to drill in deep Beaufort Sea" (September 27, 2013), accessed September 2014, http://www.cbc.ca/news/canada/north/oil-companies-seek-to-drill-in-deep-beaufort-sea-1.1871343.

24Statistics Canada, CANSIM, table 134-0001, accessed August 2014, http://www5.statcan.gc.ca/cansim/a33?RT=TABLE&themeID=2026&spMode=tables&lang=eng.

25Canada Association of Petroleum Producers, "Crude Oil: Forecast, Markets, and Transportation" (June 2014), accessed September 2014, http://www.capp.ca/getdoc.aspx?DocId=247759&DT=NTV.

26Canadian Energy Pipeline Association, http://www.cepa.com/library/cepa-member-statistics

27Enbridge, http://www.enbridge.com/DeliveringEnergy/OurPipelines/LiquidsPipelines.aspx; Canada Association of Petroleum Producers, "Crude Oil: Forecast, Markets, and Transportation" (June 2014), accessed September 2014, http://www.capp.ca/getdoc.aspx?DocId=247759&DT=NTV.

28Enbridge, Alberta Clipper and Southern Lights, accessed September 2014, http://www.enbridge.com/Alberta-Clipper-and-Southern-Lights.aspx.

29Canada Association of Petroleum Producers, "Crude Oil: Forecast, Markets, and Transportation" (June 2014), accessed September 2014, http://www.capp.ca/getdoc.aspx?DocId=247759&DT=NTV.

30TransCanada, Oil Pipelines, accessed September 2014, http://www.transcanada.com/oil-pipelines.html.

31TransCanada, Keystone XL Pipeline, accessed September 2014, http://keystone-xl.com/about/the-keystone-xl-oil-pipeline-project/.

32Davenport, Coral, "Report Finds Higher Risks If Oil Line is Not Built" (June 6, 2014), http://www.nytimes.com/2014/06/07/us/report-finds-higher-risks-if-oil-line-is-not-built.html.

33TransCanada, Keystone XL Pipeline, "Gulf Coast Project begins delivering crude oil to Nederland, Texas" (January 22, 2014), http://keystone-xl.com/gulf-coast-project-begins-delivering-crude-oil-to-nederland-texas/

34Canada Association of Petroleum Producers, "Crude Oil: Forecast, Markets, and Transportation" (June 2014), accessed September 2014, http://www.capp.ca/getdoc.aspx?DocId=247759&DT=NTV.

35Ibid

36Ibid

37National Energy Board, Canadian Crude Exports by Rail, accessed August 2014, http://www.neb-one.gc.ca/clf-nsi/rnrgynfmtn/sttstc/crdlndptrlmprdct/2014/cndncrdlxprtsrl-eng.html.

38National Energy Board, 2013 Canadian Crude Oil Exports – By Export Transportation System Summary, accessed August 2014, http://www.neb-one.gc.ca/clf-nsi/rnrgynfmtn/sttstc/crdlndptrlmprdct/cndncrdlxprttrnsprttnsstm5yr/2013/cndncrdlxprttrnsprttnsstm5yr2013-eng.html.

39Canada Association of Petroleum Producers, "Crude Oil: Forecast, Markets, and Transportation" (June 2014), accessed September 2014, http://www.capp.ca/getdoc.aspx?DocId=247759&DT=NTV.

40Ibid

41Canada Association of Petroleum Producers, Yields of Refined Petroleum Products in Canada, accessed August 2014, http://statshb.capp.ca/SHB/Sheet.asp?SectionID=7&SheetID=110.

42National Energy Board, Marketable Natural Gas Production in Canada (July 22, 2014), accessed August 2014, http://www.neb-one.gc.ca/clf-nsi/rnrgynfmtn/sttstc/mrktblntrlgsprdctn/mrktblntrlgsprdctn-eng.html.

43Hart Energy, Unconventional Oil and Gas Center, accessed August 2014, http://www.ugcenter.com/operators?business_type=operators&play=hornriver.

44Oil and Gas Journal, "Encana, CNPC to Jointly Develop Canadian Natural Gas Plays" (June 25, 2010), http://www.ogfj.com/articles/2010/06/encana_-cnpc_to_jointly.html; Horn River News, "Korea Gas to invest $1.1 billion in BC shale gas" (March 1, 2010), http://hornrivernews.com/2010/03/01/korea-gas-to-invest-1-1-billion-in-bc-shale-gas/.

45ExxonMobil, Operations, Sable Offshore Energy Project, accessed August 2014, http://www.soep.com/cgi-bin/getpage?pageid=1/0/0.

46Canada Association of Petroleum Producers, Nova Scotia, accessed August 2014, http://www.capp.ca/canadaIndustry/industryAcrossCanada/Pages/NovaScotia.aspx.

47 Encana, Deep Panuke, accessed August 2014, http://www.encana.com/operations/canada/deep-panuke.html; Canada-Nova Scotia Offshore Petroleum Board, Offshore Projects, accessed August 2014, http://www.cnsopb.ns.ca/offshore-activity/offshore-projects.

48LNG Global, "GDF SUEZ Agreement with Gaz Metro LNG of Montreal for New England Supply" (August 12, 2014), http://www.lngglobal.com/latest/gdf-suez-agreement-with-gaz-metro-lng-of-montreal-for-new-england-supply.html.

49TransCanada, 2013 Annual Report, Natural Gas Pipelines, accessed September 2014, http://annualreport.transcanada.com/Content/PDFs/TransCanada-2013-Annual-Report-NaturalGasPipelines.pdf.

50TransCanada, "Keeping the Tanker Full Into the Future" presentation (January 23, 2014), http://governmentcaucus.bc.ca/mikemorris/wp-content/uploads/sites/45/2014/02/Keeping-the-Tank-Full-Premiers-BC-Natural-Resource-Forum-Jan-23-FINAL.pdf.

51Spectra Energy, Our Processing Business in Canada, accessed September 2014, http://www.spectraenergy.com/Operations/Business-Units/Western-Canada/.

52Alliance Pipeline, B.C. Natural Gas Symposium presentation (June 4, 2014), http://www.alliancepipeline.com/Media/Multimedia/Documents/Presentations/BCNaturalGasSymposium_060414.pdf.

53Canaport LNG, accessed September 2014, http://www.canaportlng.com/.

54BP, Statistical Review of World Energy 2014, accessed August 2014, http://www.bp.com/content/dam/bp/pdf/Energy-economics/statistical-review-2014/BP-statistical-review-of-world-energy-2014-full-report.pdf.

55National Energy Board, LNG Export License Applications, accessed August 2014, http://www.neb-one.gc.ca/clf-nsi/rthnb/pplctnsbfrthnb/lngxprtlcncpplctns/lngxprtlcncpplctns-eng.html; Jang, Brent, "NEB approves two more LNG export licence applicationsm," The Globe and Mail (May 1, 2014), Â http://www.theglobeandmail.com/report-on-business/industry-news/energy-and-resources/neb-approves-two-more-lng-export-licence-applications/article18378877/.

56Reuters, "FACTBOX-Proposed LNG terminals on Canada's west coast" (December 1, 2013), http://uk.reuters.com/article/2013/12/01/canada-energy-terminals-idUKL2N0IX24M20131201.

57Natural Resources Canada, About Coal, accessed August 2014, http://www.nrcan.gc.ca/energy/coal/4277.

58Coal Association of Canada, "Economic impact analysis of the coal mining industry in Canada" (October 31, 2012), http://www.coal.ca/wp-content/uploads/2012/11/FINAL_Coal-Association-of-Canada_October-312012.pdf.

59Natural Resources Canada, About Coal, accessed August 2014, http://www.nrcan.gc.ca/energy/coal/4277.

60Ibid

61Global Energy Observatory, Current List of Hydro PowerPlants, accessed August 2014, http://globalenergyobservatory.org/list.php?db=PowerPlants&type=Hydro.

62Canada Wind Energy Association, Installed Capacity, accessed August 2014, http://canwea.ca/wind-energy/installed-capacity/.

63International Energy Agency, IEA Data Services, 2012.

The Energy Consulting Group home page